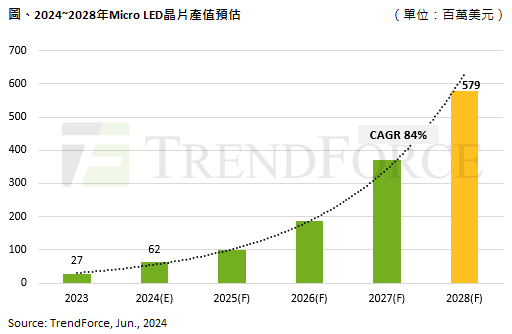

The size miniaturization project closely related to the cost reduction of Micro LED chips is still in progress. Large-scale display applications such as LGE, BOE and Vistar continue to invest, and AUO develops watch products. New display applications also have demand for head-mounted devices and cars. TrendForce's "2024 Micro LED Market Trends and Technology Cost Analysis Report" shows that the output value of Micro LED chips will reach US$580 million in 2028, with a compound growth rate (CAGR) of 84% from 2023 to 2028.

Micro LED industry development challenges

The difficulty in reducing costs and technical process challenges are the main reasons for the cancellation of Apple Watch. Therefore, continuous optimization of production is still the key to the development of the Micro LED industry. Mass transfer will gradually evolve from single technology to composite technology, such as the combination of laser transfer and seal transfer, which is expected to achieve a transfer solution with bonding capabilities and no lag. In addition, in addition to improving transfer efficiency, the core focus must also ensure that the transfer process maintains higher wafer utilization and responds to multi-faceted challenges such as high precision when wafer size shrinks.

Inspection and repair are the key to improving the yield of the manufacturing process and further affecting the cost of Micro LED. Micro LED electrical testing is continuously upgrading from the original technical foundation, with high-precision probe cards (Probe Card) and derived new detection technology "non-contact detection" (Contactless Testing) two directions, in addition to leading the development of electrical testing, are also a major business opportunity for equipment manufacturers.

The cancellation of Apple Watch has prompted chip supplier ams OSRAM to consider selling its 8-inch factory in Malaysia. If the sale target is a Micro LED display supply chain manufacturer, it will have positive benefits for industry development and cost structure optimization. From the perspective of conversion technology routes and target markets, Chinese compound semiconductor manufacturers that are actively developing 8-inch SiC power semiconductors are also potential buyers. This way of entering the international market will undoubtedly be a way for chip manufacturers to increase profits.

Micro LED industry development opportunities

From the perspective of the application market, Micro LED still has clear fundamental advantages over competing technologies such as Micro OLED. The optical engine of AR glasses must have the characteristics of high brightness and small size. The size of Micro LED optical engine has entered the era of less than 0.2cc. In terms of high brightness to improve the clarity of all-weather all-scenario recognition, Micro LED is also basically moving towards more than 350,000 nits (nits). Move forward. Coupled with the rapid development of AI assistance tools in recent years, the demand for AR glasses equipped with Micro LED displays will gradually emerge within a year or two.

On the other hand, automotive displays do not pursue the ultimate PPI, but require higher contrast and credibility. Considering driving needs, Micro LED with characteristics such as high brightness, high contrast, wide color gamut, and fast response speed is integrated into smart cockpit integrated automotive display solutions such as special-shaped, curved, flexible, and tactile feedback, which can comprehensively upgrade driving. experience. The imagination of Micro LED automotive applications is also constantly expanding. For example, it can be used as an augmented reality and panoramic head-up display (AR-HUD and P-HUD), or it can be used with transparent display windows for innovative displays.

Source: technews

原文始发于微信公众号(MicroDisplay):Micro LED chip output value reaches US$580 million in 2028, focusing on XR and automotive applications